Got 122(9) Notice from FBR – What should you do?

122(9) (Notice to amend assessment) SHOW CAUSE NOTICE U/S 122(9) OF THE INCOME TAX ORDINANCE, 2001 FOR THE AMENDMENT OF ASSESSMENT FOR TAX YEAR 2015.

122(9) (Notice to amend assessment) SHOW CAUSE NOTICE U/S 122(9) OF THE INCOME TAX ORDINANCE, 2001 FOR THE AMENDMENT OF ASSESSMENT FOR TAX YEAR 2015.

111(1) (Notice to explain Income / asset) Please refer to above. 1. You have declared income including exempt and FTR at Rs. 3,017,483/- for the

Deadline for updating Taxpayers profile is 30 March 2021. In order to avoid penalty, taxpayers are required to update their profile. After login on IRIS

Individuals can get your National Tax Number (NTN) from FBR. The process is easy nowadays. You don’t need to visit the Federal Board of Revenue office.

Table of Contents The Federal Board of Revenue (FBR) has published the Active Taxpayers’ List (ATL) for Tax Year 2023 on March 1, 2024, in

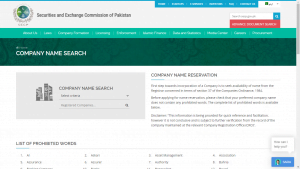

How To Search Company Name (SECP) Online? Updated 2021

Tax Asaan is a mobile application launched by FBR to

facilitate taxpayers. It is available free on Android and iOS smart phones. APP based Income Tax Return filing

option is also available in Iris. This feature will help taxpayer to

proceed step by step utilizing interactive questions for return filing.

Partnership Firm /Trust For partnership firm registration in Pakistan following documents are required Minimum two persons are required. Full Name, Father or Husband Name, Residential

Private Company Registration Private Company with Resident Directors Company Name Reservation Company Name Reservation is the first process in company registration. Only a successfully reserved

Individual An Individual can start business by getting NTN from FBR, or if an individual already have NTN than only new Business would be added