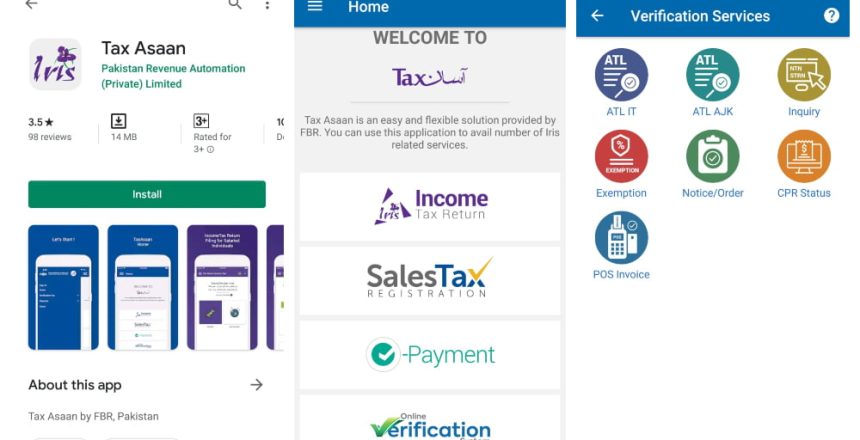

What is Tax Asaan App?

Tax Asaan is a mobile application launched by FBR to

facilitate taxpayers. It is available free on Android and iOS smart phones. APP based Income Tax Return filing

option is also available in Iris. This feature will help taxpayer to

proceed step by step utilizing interactive questions for return filing.

What are the features of Tax Asaan App?

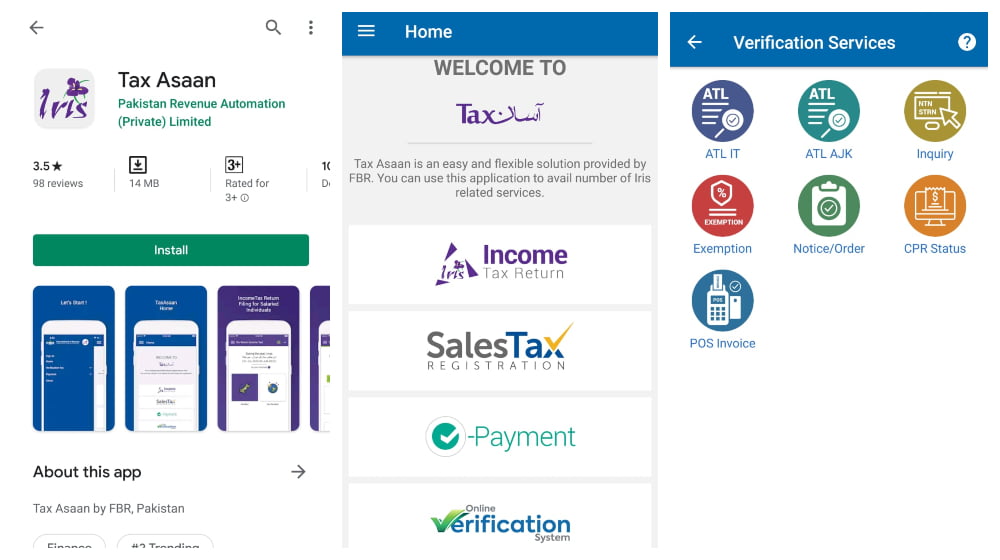

- Tax Asaan offers following facilities for taxpayer:

- I. Registration of Income Tax

- II. Registration of Sales Tax

- III. Return filing for Salaried Individuals

- IV. Recovery of Password

- V. Creation of Tax payments, PSIDs

- VI. POS Invoice Verification

- VII. FBR Maloomat

Do I need to register Tax Asaan account separately?

If you are already registered in IRIS, separate registration is

not required for Tax Asaan. The same username and password work

both for Tax Asaan and IRIS.

I file my return in IRIS, but now I want to file

through Tax Asaan?

If you have created draft in IRIS, then you can delete the

draft in IRIS and start filing in Tax Asaan.

What is difference between TaxAsaan and IRIS?

Tax Asaan offers APP-based interface for filing details

which is more easy and suitable for salaried taxpayers having less

complex details. You can download the iOS and Android version of the APP

Can I file tax returns of all previous years through Tax Asaan?

Tax Asaan currently only supports filing for return for

2019 onwards.

How many steps involved in Tax Asaan APP to file my taxes?

A taxpayer can file his return in eight steps either through

the Tax Asaan or APP based filing system by answering simple

questions.

Do i classify as a Resident?

An individual will be a resident individual in a tax year if the

individual

(a) is present in Pakistan for a period of, or periods amounting in

aggregate to, 183 days or more in the tax year;

[(ab) is present in Pakistan for a period of, or periods amounting

in aggregate to, 120 days or more in the tax year and, in the 4

years preceding the tax year, has been in Pakistan for a period of,

or periods amounting in aggregate to, 365 days or more; or

(c) is an employee or official of the Federal Government or a

Provincial Government posted abroad in the tax year.

How can I recover password for my Tax Asaan App Account?

A taxpayer can recover the password of TaxAsaan by using

his registered email and phone number without going to tax office.