FBR Extended Taxpayers Profile Update Time Till 30 June 2021

FBR has extended taxpayers profile update time till 30 June 2021. Previously it was 31 March 2021. FBR issued circular on 26/03/2021 while exercising its powers, for extension in time, for updating taxpayers’ profile for a period of 3 months.

31 March 2021, Last date for Taxpayers’ profile update..

Deadline for updating Taxpayers profile is 30 March 2021. In order to avoid penalty, taxpayers are required to update their profile. After login on IRIS taxpayers can update their profile by adding complete details of Bank along with IBAN.

How to get NTN in Pakistan

Individuals can get your National Tax Number (NTN) from FBR. The process is easy nowadays. You don’t need to visit the Federal Board of Revenue office. You can get your NTN by themselves or via professionals. Basic requirements before starting the process of getting NTN are as under: Copy of CNIC of the person who wants […]

How many types of business entities are in Pakistan?

There are four types of businesses each with its own legal structure and rules. These are as under: Sole Proprietorships, Un-Registered Partnerships, Limited Liability Partnership (LLP) registered from SECP, and Limited Company or Limited Liability Company (PVT Ltd in Pakistan). Before starting business, entrepreneurs should carefully decide which type of business structure is best suited to their type of […]

How To Register Private Company in Pakistan? (Updated-2021)

Private Limited Company Registration in Pakistan All you need to know A Private Limited Company offers limited liability and legal protection to its shareholders. A Private Limited Company in Pakistan lies somewhere between a partnership firm and a widely owned public company. It can be registered with a minimum of two people. A person can […]

How to Check your ATL Status in FBR? (Updated-2021)

Table of Contents Federal Board of Revenue has published ‘’The Active Taxpayers’ List” for Tax Year 2020 on 01/03/2021 i.e. 1st March, 2021 in accordance with the provisions of Rule 81B of Income Tax Rules, 2002. ATL is published for every financial year on 1st March next year showing ATL status and is valid up […]

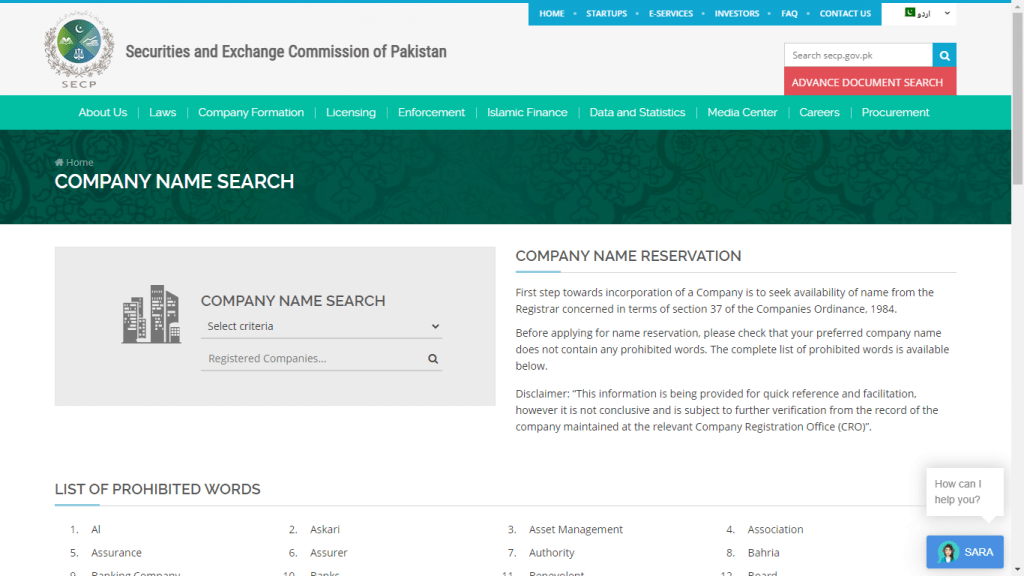

How To Easily Search Company Name Available For Business Registration in Pakistan (Private Limited/ Limited/ Limited Liability Partnership(LLP)

How To Search Company Name (SECP) Online? Updated 2021

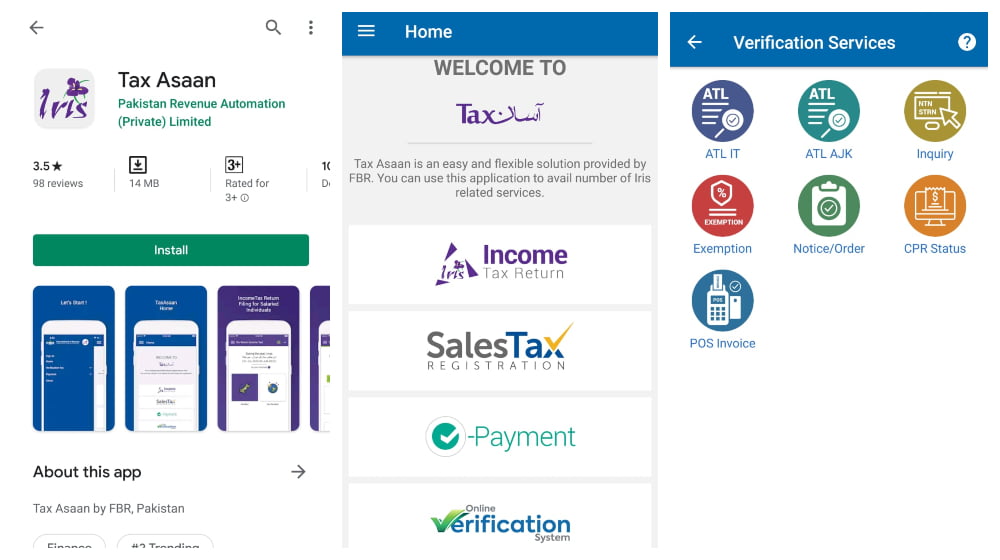

Tax Asaan App Easy Guide

Tax Asaan is a mobile application launched by FBR to

facilitate taxpayers. It is available free on Android and iOS smart phones. APP based Income Tax Return filing

option is also available in Iris. This feature will help taxpayer to

proceed step by step utilizing interactive questions for return filing.

How do I pay my ATL Surcharge?

ATL (Active Tax Payer) list is based upon the basis of tax return filled for tax year 2019. Late filers of Tax Return 2019 are not included in ATL. They After filing Income Tax Return for TY 2019, can pay “Surcharge for ATL” by following the below steps.

Islamabad Chamber of Commerce and Industry (ICCI) Membership Procedure and Registeration Form

Updated (2021) Membership Eligibility Conditions(Membership period one year: April 01 to March 31 each year) Islamabad Chamber of Commerce Industry (ICCI) entertains those applications for Membership whose Head Office or Registered Office or Branch Office is located within the jurisdiction of Islamabad Capital Territory (ICT) Procedure Please follow the below mentioned procedure for getting membership […]