How to get a Ufone Tax Certificate in Pakistan

Methods to Obtain a Ufone Tax Certificate

Ufone provides convenient online options for obtaining the tax certificate through its Self Care portal and the My Ufone app. You can also visit a Ufone service center for in-person assistance.

Online Methods

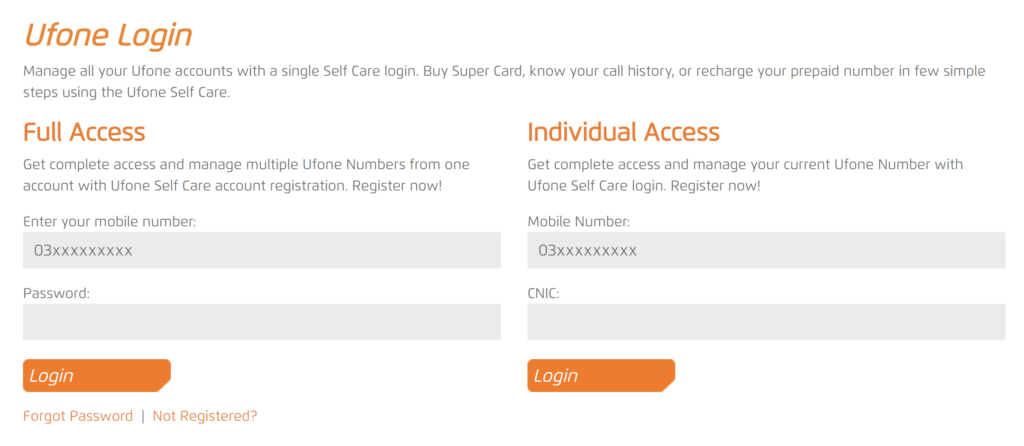

1. Ufone Self Care Portal https://www.ufone.com/selfcare/app/login/login.php

- Log In: Visit the Ufone Self Care website. Enter your mobile number and CNIC number in the Individual Access section, and click the Login button.

- Enter PIN: You will receive an SMS with a PIN on your Ufone SIM. Enter this PIN to proceed.

- Access Tax Certificate: Navigate to the “Usage” menu and select the “Tax Certificate” option.

- Select Period: Choose the start and end month and year for which you need the certificate.

- Download: Click the Download button to get your tax certificate.

2. My Ufone App Now Called (UPTCL– App Up Your Life!)

- Download App: Install the My Ufone app from the Google Play Store or Apple App Store.

- Log In: Sign in using your Ufone number.

- Access Tax Certificate: On the home page, find and click on the “Tax Certificate” tab.

- Select Period: Choose the start and end month and year for the certificate.

- Receive Certificate: Enter your email address and submit the request. The certificate will be emailed to you.

Visiting Ufone Service Centers

For those who prefer in-person assistance, visiting a Ufone service center is an option.

- Locate a Service Center: Use the online store locator or contact Ufone customer service to find the nearest service center.

- Visit the Center: Go to the service center during operating hours.

- Request Certificate: Ask a customer service representative for your tax certificate. Provide necessary identification and account details for verification.

Tips for a Smooth Process

- Ensure Accuracy: Double-check all personal and account details to avoid delays.

- Secure Credentials: Keep your login credentials safe to prevent unauthorized access.

- Check Certificate Details: Verify the accuracy of the information on your tax certificate before downloading or accepting it.

Conclusion

Obtaining a Ufone tax certificate is a simple and cost-free process that can be completed online or in person. Whether you choose the convenience of the online methods or prefer visiting a service center, Ufone provides multiple options to cater to your needs. By following the steps outlined above, you can easily access your tax certificate for any necessary purposes, ensuring you are prepared for tax filings or other official requirements.

Understanding the Ufone Tax Certificate

A Ufone tax certificate serves as proof of the taxes deducted on your mobile usage over a specified period. It includes details like the amount of tax paid and the duration for which it was paid. This document is essential for tax filings and other official purposes, making it important for Ufone subscribers to know how to access it easily.

About ABH Tax Consultants

ABH Tax Consultants is a premier tax consulting firm based in Islamabad, Pakistan, providing expert services to individuals and businesses. We specialize in tax filing, company registration, and ensuring compliance with FBR regulations. Our team is dedicated to helping you navigate the complexities of the tax system with ease and precision. Whether you are a salaried individual, freelancer, or an overseas Pakistani, ABH Tax Consultants offers tailored solutions to meet your unique needs. Contact us today for professional assistance in managing your tax obligations.