How to Check Your National Tax Number (NTN) in Pakistan

- Online Verification via FBR Portal

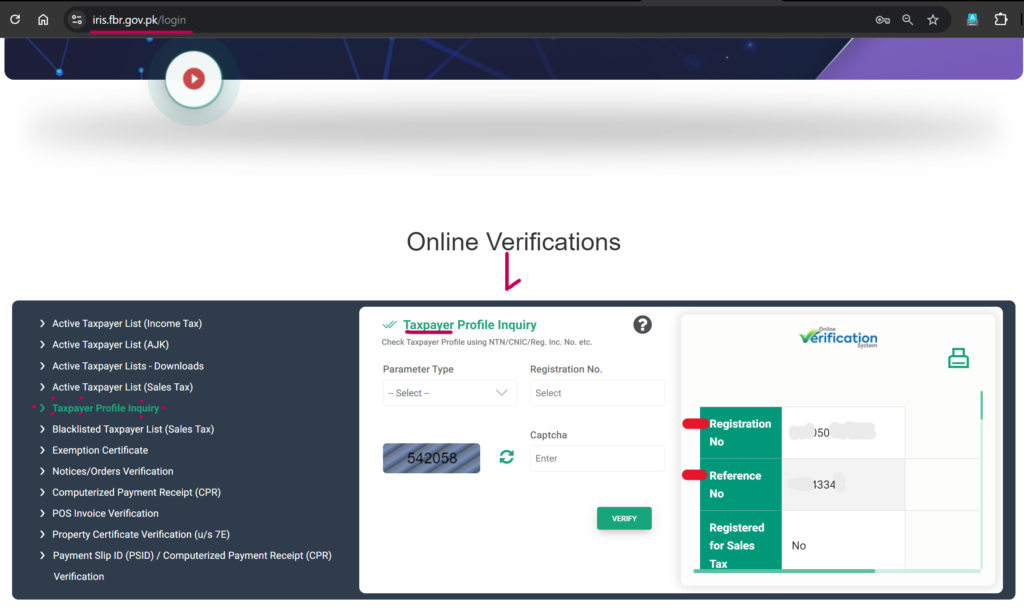

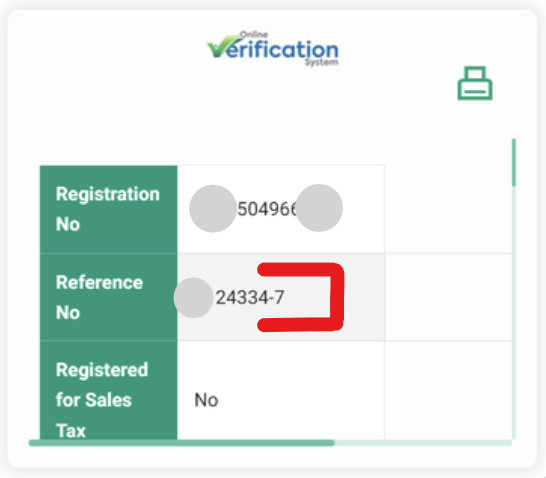

The term “Reference No.” on the FBR portal Online Verifications, Taxpayer Profile Inquiry is equivalent to the NTN. The most straightforward method to check your NTN is through the FBR’s online portal. Here’s how you can do it:- Visit the FBR Website: Go to the official FBR website at iris.fbr.gov.pk/login

- Navigate to Online Verifications: Scroll down to find the “Online Verifications” section.

- Select Taxpayer Profile Inquiry: Click on the “Taxpayer Profile Inquiry” option from the left sidebar.

- Choose Parameter Type: Select “CNIC” from the drop-down menu.

- Enter Required Information: Provide your CNIC number in the designated field and complete the captcha.

- Submit the Inquiry: Click the “Submit” button to proceed.

- View Results: The system will not display your NTN directly but will show your Reference No., which is referred to as your NTN, and related taxpayer details, such as the Regional Tax Office (RTO) and personal information linked with your NTN. The 9-digit reference number, including the dash (-), represents your NTN. The number that follows the dash (-) is typically referred to as the “check digit”.

- Using the TAX Asaan Mobile Application

The FBR has developed the TAX Asaan mobile app to facilitate taxpayers. This app provides a user-friendly interface to check your NTN number and access other tax-related services.- Download the App: Available on both Android and iOS platforms.

- Register or Log In: Use your credentials to access the app.

- Access NTN Verification: Navigate to the Online Verifications, Taxpayer Profile Inquiry section and enter your CNIC to retrieve your Reference No./NTN number.

Types of NTN

Understanding the type of NTN you have is essential for accurate verification:

- Personal NTN: Issued to individuals and linked with their CNIC. Applicable to both salaried and business individuals.

- Association of Persons (AOP) / Partnership NTN: Issued to partnerships or associations of individuals.

- Company NTN: Issued to registered companies, using the Incorporation or Company Registration Number provided by the Securities and Exchange Commission of Pakistan (SECP).

Responsibilities of NTN Holders

As an NTN holder, you are obligated to file your annual income tax returns by the due dates set by the FBR. For individuals, the deadline is typically September 30th, while companies may have deadlines at the end of September or December, depending on their fiscal year.

Conclusion

Checking your NTN number in Pakistan is a straightforward process, thanks to the FBR’s online and offline services. By ensuring you have your NTN number verified, you can confidently manage your tax obligations and avoid any potential legal issues. Keep your NTN and CNIC numbers secure, and regularly check your status to stay compliant with Pakistan’s tax regulations. Whether you choose the online portal, mobile app, or SMS service, verifying your NTN has never been easier.

About ABH Tax Consultants

ABH Tax Consultants is a leading tax consulting firm based in Islamabad, Pakistan, offering expert tax consultancy services to individuals and businesses alike. We specialize in tax filing, company registration, and ensuring compliance with FBR regulations. Our dedicated team helps you navigate the complexities of the tax system with ease and precision. Whether you’re a salaried individual, freelancer, or an overseas Pakistani, ABH Tax Consultants provides tailored solutions to meet your unique needs. Contact us today for professional assistance in managing your tax obligations.