How to Check Your Filer Status with the FBR

Staying informed about your tax status is crucial for compliance in Pakistan. The Federal Board of Revenue (FBR) offers several convenient methods to check if you’re a registered filer. Here’s a simple guide by ABH Consultants to help you verify your filer status and understand its importance.

Methods to Check Your Filer Status

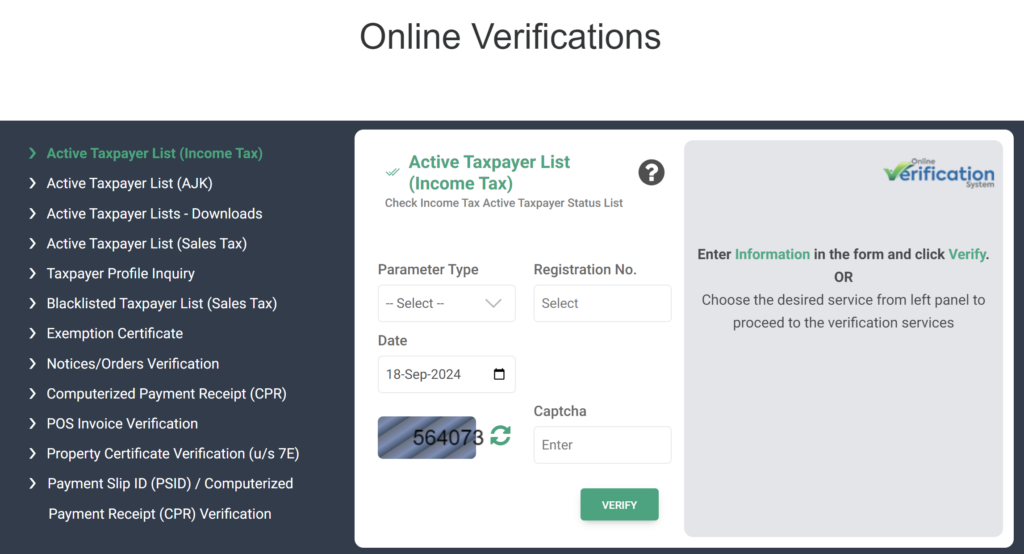

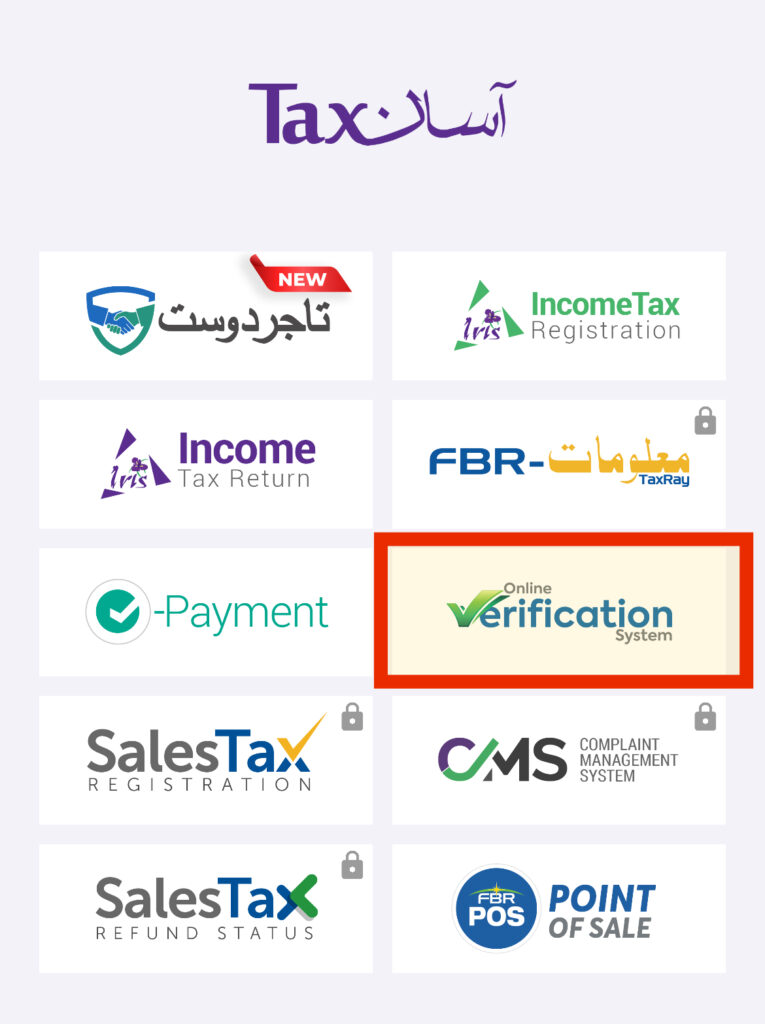

1. Online Verification via FBR Website

Step-by-Step Guide:

- Visit the New FBR IRIS website: Go to the new official FBR IRIS website (https://iris.fbr.gov.pk/#verifications).

- Scroll and Access the Online Verifications Service: Look for the “Online Verification Services“.

- Enter your information (See Image Below): Provide one of the following:

- Computerized National Identity Card (CNIC) number for individuals and enter the current date today

- National Tax Number (NTN) for businesses or Associations of Persons (AOP)

- Passport number (for non-residents)

- Select the appropriate parameter type: Choose the correct option for Parameter Type (NTN, CNIC, or Passport No.) from the dropdown menu, enter the correct Captcha and click verify.

- Review the results: The system will display your filer status, showing whether you are an active taxpayer or not.

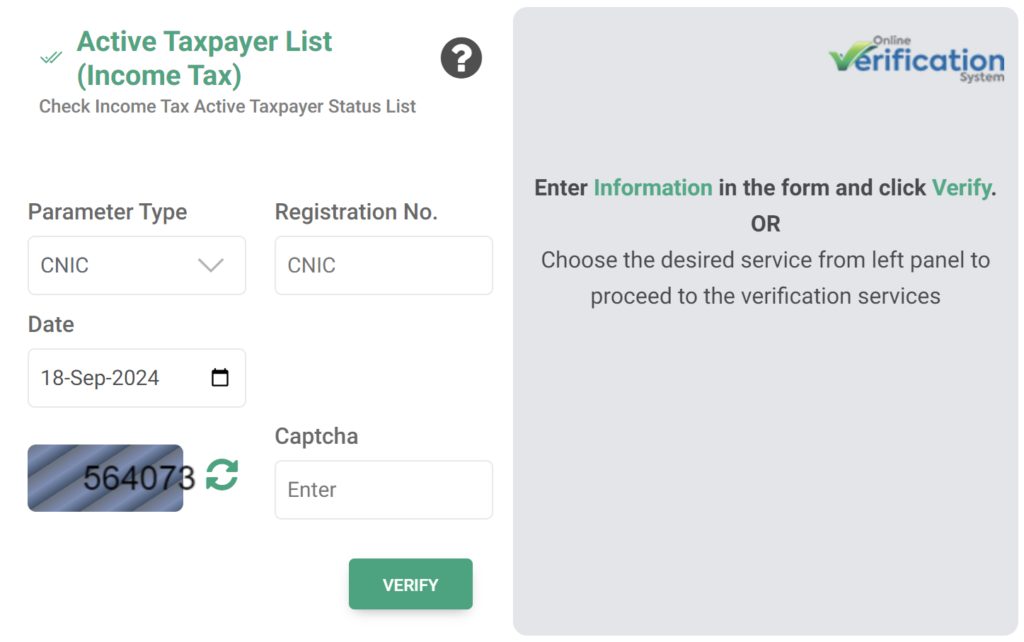

2. SMS Verification

For those without internet access, the FBR provides an easy SMS verification method. How to Use SMS Verification:

- Send an SMS to 9966 with the text:

ATL <space> 13-digit CNIC No. - You will receive a reply with your tax status.

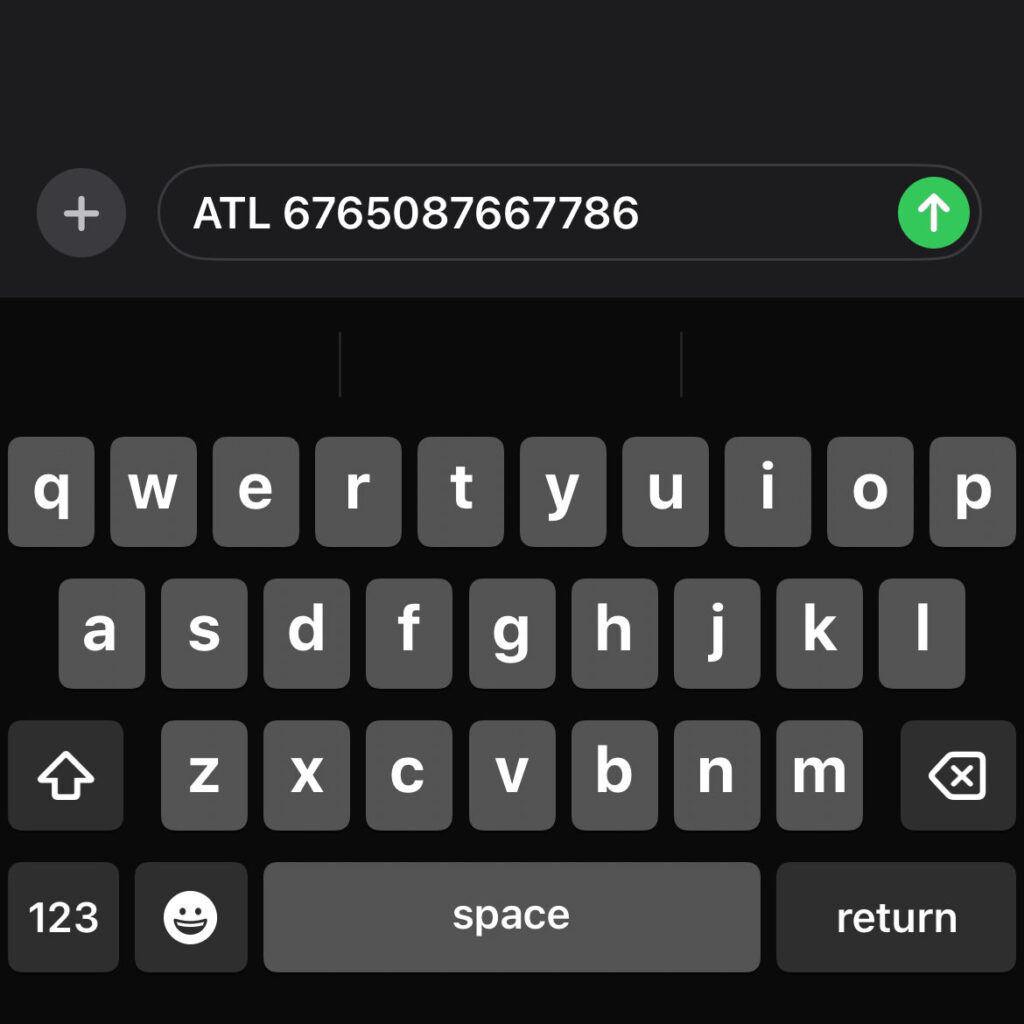

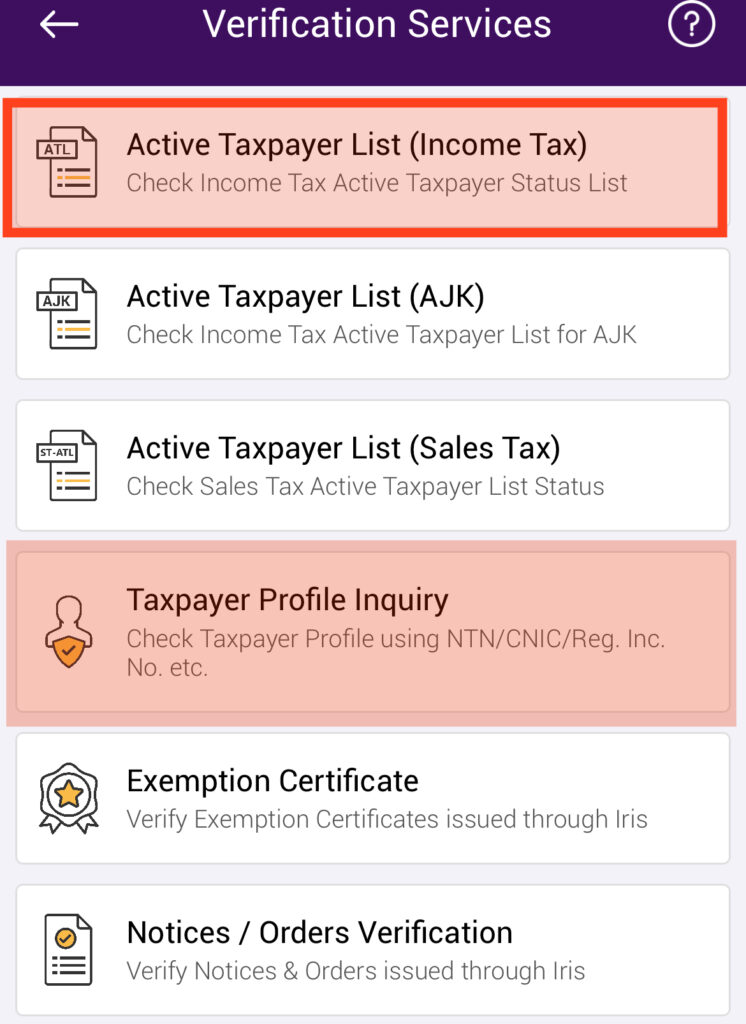

3. FBR Tax Asaan Mobile App

Steps to Check Your Status:

- Download the FBR Tax Asaan mobile app from the app store.

- Open the app and navigate to the Active Taxpayer List section.

- Enter your CNIC, NTN, or Passport number to check your filer status.

4. Downloadable Excel List

The FBR also provides the option to download the Active Taxpayer List (ATL) in Excel format from their website. This list is updated every Monday and published annually on March 1st for the previous tax year.

Benefits of Being on the ATL

Being on the Active Taxpayer List offers several benefits:

- Lower tax rates: Enjoy reduced tax rates on various transactions.

- Tax refunds: Eligible to claim tax refunds.

- Avoid higher withholding taxes: Maintaining an active filer status helps avoid higher withholding tax rates on certain transactions.

If You’re Not on the ATL

If you find that you’re not on the ATL or have a non-filer status, you may need to file your tax return or pay a surcharge to be included on the list. The surcharge amounts vary depending on the type of taxpayer:

- Companies: PKR 20,000

- Associations of Persons: PKR 10,000

- Individuals: PKR 1,000

Maintaining an active filer status is crucial for avoiding higher withholding tax rates and enjoying various financial benefits in Pakistan. Read more about benefits of being a Tax Filer.

Need Expert Assistance?

For further assistance and services, ABH Tax Consultants Islamabad is here to provide expert advice and services to navigate your tax obligations effectively.

By staying informed and proactive about your tax status, you can ensure compliance and take advantage of the benefits offered to active taxpayers in Pakistan.