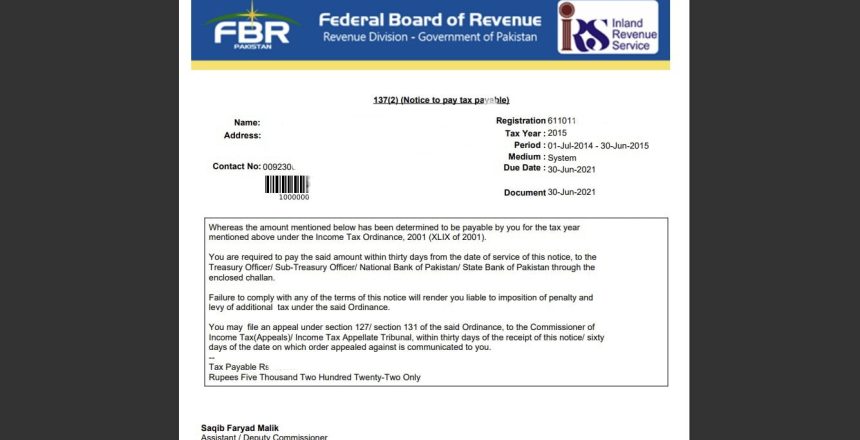

137(2) (Notice to pay tax payable)

Whereas the amount mentioned below has been determined to be payable by you for the tax year mentioned above under the Income Tax Ordinance, 2001 (XLIX of 2001).

You are required to pay the said amount within thirty days from the date of service of this notice, to the Treasury Officer/ Sub-Treasury Officer/ National Bank of Pakistan/ State Bank of Pakistan through the enclosed challan.

Failure to comply with any of the terms of this notice will render you liable to imposition of penalty and levy of additional tax under the said Ordinance.

You may file an appeal under section 127/ section 131 of the said Ordinance, to the Commissioner of Income Tax(Appeals)/ Income Tax Appellate Tribunal, within thirty days of the receipt of this notice/ sixty days of the date on which the order appealed against is communicated to you.

–Tax Payable Rs.123456890

you may receive this in e-mail

When do you receive 137(2) notice from FBR?

Where any tax is payable under an assessment or amended assessment order issued by commissioner under income tax ordinance 2001, you will get this notice.

Why you got 137(2) notice from FBR?

When tax liability is assessed by commissioner in passing an order than you will get this notice in the specified format mentioning two optins

1: The sum so specified will be payable within 30 days of the receive of this notice.

2: File an appeal to the commissioner appeals within 30days from the receipt of this notice.

What should you do after receiving 137(2) notice from FBR?

You will prepare the tax challan by logging in or using guest_user from eFBR – Taxpayer Facilitation Portal

Tax payment nature must be “Demanded Income Tax”

Year selected must be for which the order is passed

You must deposit the demanded income tax within 30 days from the receipt of notice

If you have received a notice under Section 137(2) from the Federal Board of Revenue (FBR) in Pakistan, it means that you are required to pay the tax liability specified in the notice. Here’s what you should do:

Steps to Handle a Section 137(2) Notice

1. Understand the Notice

- Purpose: The notice under Section 137(2) is issued to demand payment of tax that has been assessed and is due. This could be the result of an audit, an amended assessment, or any other tax determination by the FBR.

- Content: The notice will specify the amount of tax due, the tax period it pertains to, and the deadline for payment.

2. Review the Tax Liability

- Verify the Amount: Carefully review the amount of tax due as stated in the notice. Cross-check this with your records and any previous communications from the FBR.

- Assessment Details: Ensure you understand the basis of the tax assessment. If the notice is a result of an amended assessment, review the details of the amendment.

3. Arrange for Payment

- Payment Methods: The notice will typically provide instructions on how to make the payment. Payments can usually be made through the FBR’s online portal (IRIS), via bank transfer, or other specified methods.

- Deadline: Make sure to pay the amount due by the deadline specified in the notice to avoid additional penalties and interest.

4. Seek Clarification if Needed

- Contact FBR: If you have any questions or need clarification regarding the notice, contact the FBR. Use the contact information provided in the notice or visit the nearest FBR office.

- Professional Advice: If the tax assessment is complex or if you disagree with the assessment, consider consulting a tax advisor or a professional with expertise in Pakistani tax law.

5. Consider Filing an Appeal

- Grounds for Appeal: If you believe the tax assessment is incorrect, you have the right to file an appeal. The notice should outline the process for lodging an appeal.

- Appeal Deadline: Appeals must be filed within a specific timeframe, typically within 30 days from the date of the notice. Ensure you adhere to this deadline.

6. Document Everything

- Keep Records: Maintain a record of all communications with the FBR, copies of the notice, proof of payment, and any documents related to the tax assessment and your response.

Reach out to help if you are unable to file your Tax Returns Properly